"Helping Secure Your Best Retirement"

As you age, it’s important to plan for your financial future and retirement. While traditional mortgages are often used to purchase a home, a reverse mortgage for purchase could be a better option for seniors who want to invest in their home while maintaining their financial security.

A reverse mortgage for purchase is a financial product that allows seniors to purchase a home without having to make traditional mortgage payments. This method is also known as a Home Equity Conversion Mortgage (HECM) for purchase. With a reverse mortgage for purchase, seniors use the equity in their old home to buy a new one without having to worry about monthly mortgage payments.

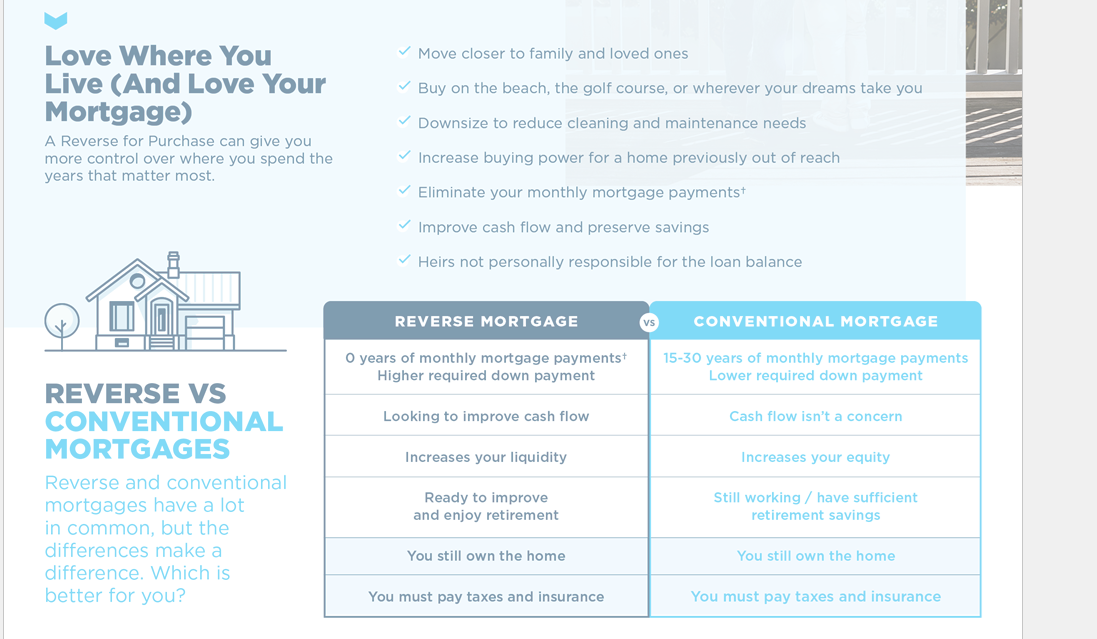

The reverse mortgage for purchase product offers several benefits that make it a preferred option for seniors. One of the most significant benefits is that a reverse mortgage for purchase eliminates the need for ongoing monthly mortgage payments. This means you can own a home without the worry and stress of making mortgage payments every month. Instead, you can use the equity in your home to pay for any expenses related to your new home or your life in retirement.

Another benefit is that with a reverse mortgage for purchase, you can move into a new home quickly and without stress. The product includes less stringent credit requirements compared to traditional mortgages, making it easier for seniors to qualify. If you are interested in buying a bigger or more expensive home, a jumbo reverse mortgage is also available.

A reverse mortgage for purchase is a great option for seniors who want to move into a home that is closer to family or is better suited for their retirement lifestyle. For example, you might want to move to a warmer climate to escape harsh winters, downsize your current home, or move to a more accessible property with fewer stairs.

The amount of money you can borrow with a reverse mortgage for purchase depends on your age and the value of your home. The older you are, the higher the amount you can borrow. With a jumbo reverse mortgage, the maximum lending limit is $4 million.

Like any financial product, a reverse mortgage for purchase comes with its own set of risks. One of the risks associated with a reverse mortgage for purchase is that the loan must be repaid when the borrower passes away or the home is sold. This means the borrower’s heirs may not inherit any equity from the home, and the equity is used to repay the loan.

Another risk is that the borrower must maintain the home to keep it in a livable condition. This means the borrower must be able to afford repairs, property taxes, and homeowner’s insurance. Additionally, if the borrower fails to pay property taxes or homeowners’ insurance, the reverse mortgage can become due.

Yes, there are fees associated with a reverse mortgage for purchase. These fees may include an origination fee, insurance premiums, and closing costs. However, these costs are often included in the loan, making it easier for seniors to afford them.

Let us know and one of our lending professionals will be happy to answer any of your questions.

Personal NMLS#126017

Company NMLS# 1842513

Reverse Mortgage Northwest

19324 69th Place West #7

Lynnwood, WA 98036

These materials are not from HUD, FHA, the USDA, or the VA. These materials were not approved by any government agency. They are independent of any government agency. We are not in any way affiliated with any organization listed or referenced within this website, including HUD/FHA/USDA/VA. The inclusion of various education, information, web links, or materials are not an endorsement of the Sender or any of its employees or business partners. For information directly from HUD/FHA, visit https://www.hud.gov/guidance For information directly from the VA, visit http://www.benefits.va.gov/HOMELOANS/ For information directly from the USDA, visit http://www.usda.gov/wps/portal/usda/usdahome?navid=GRANTS_LOANS